Εισάγετε μια λέξη ή φράση σε οποιαδήποτε γλώσσα 👆

Γλώσσα:

Μετάφραση και ανάλυση λέξεων από την τεχνητή νοημοσύνη ChatGPT

Σε αυτήν τη σελίδα μπορείτε να λάβετε μια λεπτομερή ανάλυση μιας λέξης ή μιας φράσης, η οποία δημιουργήθηκε χρησιμοποιώντας το ChatGPT, την καλύτερη τεχνολογία τεχνητής νοημοσύνης μέχρι σήμερα:

- πώς χρησιμοποιείται η λέξη

- συχνότητα χρήσης

- χρησιμοποιείται πιο συχνά στον προφορικό ή γραπτό λόγο

- επιλογές μετάφρασης λέξεων

- παραδείγματα χρήσης (πολλές φράσεις με μετάφραση)

- ετυμολογία

joint and several liability - translation to ρωσικά

LEGAL TERM

Joint and Several Liability; Joint and several; Several liability; Joint liability; Jointly liable; Severally liable; Jointly and severally liable; Joint tortfeasors; Jointly and severally; Joint-responsibility rule; Joint tortfeasance

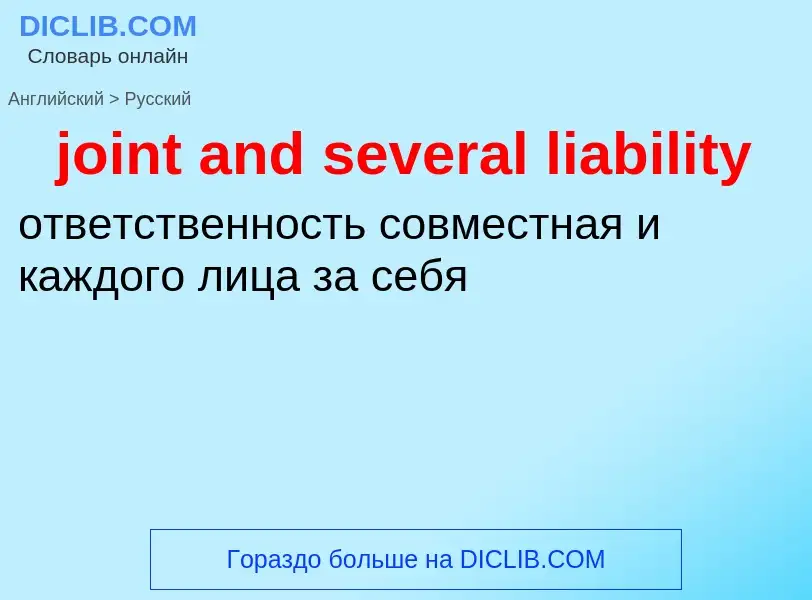

joint and several liability

ответственность совместная и каждого лица за себя

joint and several liability

совокупное и раздельное обязательства

jointly liable

[юр.] солидарно обязанный /ответственный/

Βικιπαίδεια

Joint and several liability

Where two or more persons are liable in respect of the same liability, in most common law legal systems they may either be:

- jointly liable, or

- severally liable, or

- jointly and severally liable.

Παραδείγματα από το σώμα κειμένου για joint and several liability

1. In the 2003 Budget the government introduced "joint and several" liability, meaning that traders in the supply chain could be held responsible, either individually or jointly, for paying any VAT liability that had been fraudulently withheld by another member of the supply chain.

2. The anti–fraud law, known as "joint and several" liability is one of the recent measures introduced to address the escalating problem of "missing trader" or carousel fraud, which involves a chain of cross–border purchases of small, high–value items such as computer chips or mobile phones.

3. Revenue & Customs also welcomed the ruling, which it said was "firm and final confirmation that member states may legally prevent abuse of the VAT system and protect revenues by applying joint and several liability". "Traders that do not take reasonable precautions are at risk of being liable for unpaid VAT.