Traducción y análisis de palabras por inteligencia artificial ChatGPT

En esta página puede obtener un análisis detallado de una palabra o frase, producido utilizando la mejor tecnología de inteligencia artificial hasta la fecha:

- cómo se usa la palabra

- frecuencia de uso

- se utiliza con más frecuencia en el habla oral o escrita

- opciones de traducción

- ejemplos de uso (varias frases con traducción)

- etimología

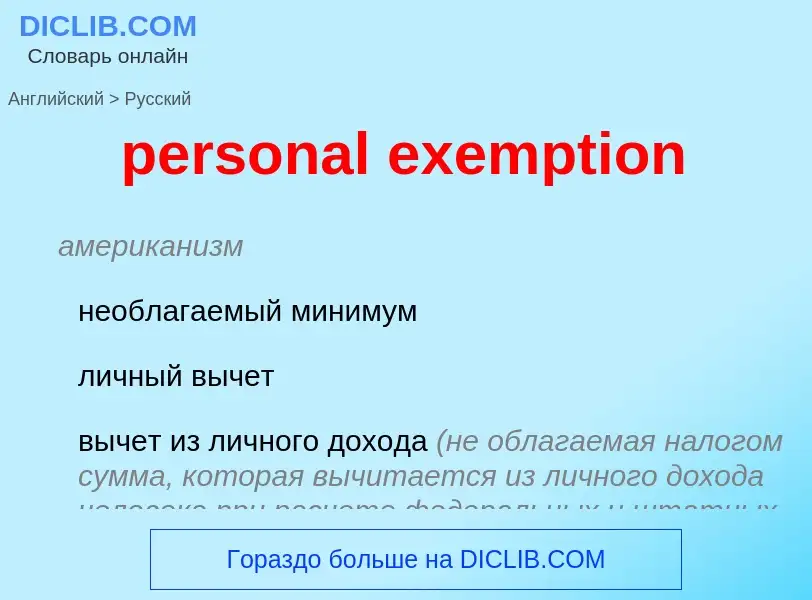

personal exemption - traducción al Inglés

американизм

необлагаемый минимум

личный вычет

вычет из личного дохода (не облагаемая налогом сумма, которая вычитается из личного дохода человека при расчете федеральных и штатных подоходных налогов)

синоним

Смотрите также

общая лексика

сосед справа (в строю)

'правая рука', верный помощник

Definición

is also used. (BUSINESS)

Wikipedia

Under United States tax law, a personal exemption is an amount that a resident taxpayer is entitled to claim as a tax deduction against personal income in calculating taxable income and consequently federal income tax. In 2017, the personal exemption amount was $4,050, though the exemption is subject to phase-out limitations. The personal exemption amount is adjusted each year for inflation. The Tax Cuts and Jobs Act of 2017 eliminates personal exemptions for tax years 2018 through 2025.

The exemption is composed of personal exemptions for the individual taxpayer and, as appropriate, the taxpayer's spouse and dependents, as provided in Internal Revenue Code at 26 U.S.C. § 151.