Traduzione e analisi delle parole tramite l'intelligenza artificiale ChatGPT

In questa pagina puoi ottenere un'analisi dettagliata di una parola o frase, prodotta utilizzando la migliore tecnologia di intelligenza artificiale fino ad oggi:

- come viene usata la parola

- frequenza di utilizzo

- è usato più spesso nel discorso orale o scritto

- opzioni di traduzione delle parole

- esempi di utilizzo (varie frasi con traduzione)

- etimologia

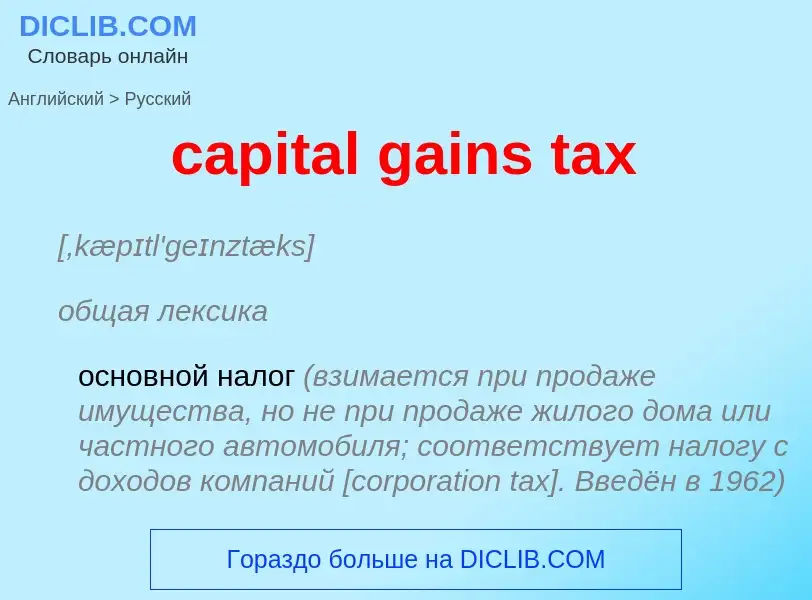

capital-gains tax - traduzione in Inglese

[,kæpɪtl'geɪnztæks]

общая лексика

основной налог (взимается при продаже имущества, но не при продаже жилого дома или частного автомобиля; соответствует налогу с доходов компаний [corporation tax]. Введён в 1962)

налог на увеличение рыночной стоимости капитала

2) бухг. выигрыш от продажи капитального имущества (превышение выручки над оценкой с учётом износа), рост стоимости капитального имущества

Definizione

Wikipedia

A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate, and property.

Not all countries impose a capital gains tax and most have different rates of taxation for individuals versus corporations. Countries that do not impose a capital gains tax include Bahrain, Barbados, Belize, Cayman Islands, Isle of Man, Jamaica, New Zealand, Sri Lanka, Singapore, and others. In some countries, such as New Zealand and Singapore, professional traders and those who trade frequently are taxed on such profits as a business income. In Sweden, the Investment Savings Account (ISK – Investeringssparkonto) was introduced in 2012 in response to a decision by Parliament to stimulate saving in funds and equities. There is no tax on capital gains in ISKs; instead, the saver pays an annual standard low rate of tax. Fund savers nowadays mainly choose to save in funds via investment savings accounts.

Capital gains taxes are payable on most valuable items or assets sold at a profit. Antiques, shares, precious metals and second homes could be all subject to the tax if the profit is large enough. This lower boundary of profit is set by the government. If the profit is lower than this limit it is tax-free. The profit is in most cases the difference between the amount (or value) an asset is sold for and the amount it was bought for.

The tax rate on capital gains may depend on the sellers income. For example, in the UK the CGT is currently (tax year 2021–22) 10% for incomes under £50,000 and 20% for larger incomes. There is an additional tax that adds 8% to the existing tax rate if the profit comes from residential property. If any property is sold with loss, it is possible to offset it against annual gains. The CGT allowance for one tax year in the UK is currently £12,300 for an individual and double (£24,600) for a married couple or in a civil partnership. For equities, an example of a popular and liquid asset, national and state legislation often has a large array of fiscal obligations that must be respected regarding capital gains. Taxes are charged by the state over the transactions, dividends and capital gains on the stock market. However, these fiscal obligations may vary from jurisdiction to jurisdiction.

![Hoard of ancient gold coins reminiscent of the [[Babylonia]]n currency. Hoard of ancient gold coins reminiscent of the [[Babylonia]]n currency.](https://commons.wikimedia.org/wiki/Special:FilePath/Hoard of ancient gold coins.jpg?width=200)

![capital]]. capital]].](https://commons.wikimedia.org/wiki/Special:FilePath/Money-2180330 1920.jpg?width=200)