Tradução e análise de palavras por inteligência artificial ChatGPT

Nesta página você pode obter uma análise detalhada de uma palavra ou frase, produzida usando a melhor tecnologia de inteligência artificial até o momento:

- como a palavra é usada

- frequência de uso

- é usado com mais frequência na fala oral ou escrita

- opções de tradução de palavras

- exemplos de uso (várias frases com tradução)

- etimologia

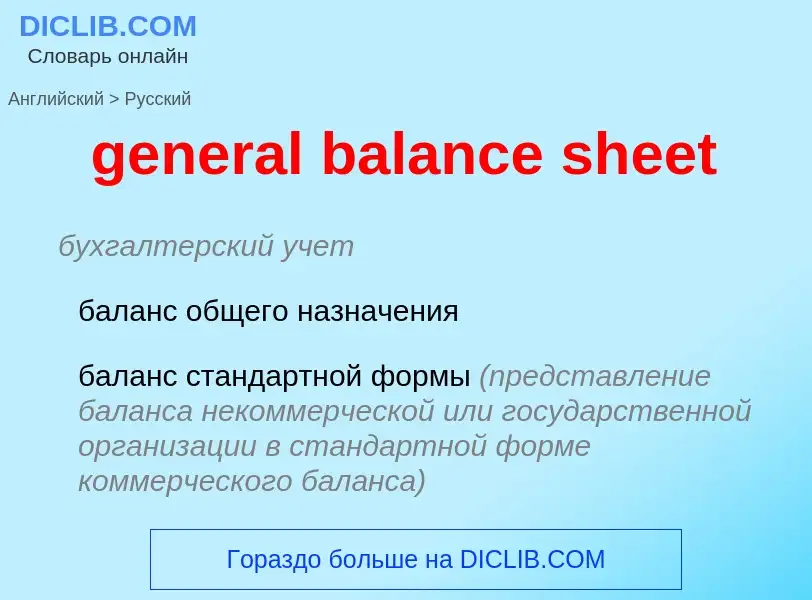

general balance sheet - tradução para russo

бухгалтерский учет

баланс общего назначения

баланс стандартной формы (представление баланса некоммерческой или государственной организации в стандартной форме коммерческого баланса)

Смотрите также

[səb'stænʃieit]

общая лексика

обосновать

глагол

общая лексика

обосновывать (что-л.)

приводить достаточные основания

подкреплять доказательствами

делать реальным

придавать конкретную форму

воплощать

придавать твёрдость

прочность

приводить достаточные основания, доказывать, подтверждать

придавать конкретную форму, делать реальным

Definição

Wikipédia

Off balance sheet (OBS), or incognito leverage, usually means an asset or debt or financing activity not on the company's balance sheet. Total return swaps are an example of an off-balance-sheet item.

Some companies may have significant amounts of off-balance-sheet assets and liabilities. For example, financial institutions often offer asset management or brokerage services to their clients. The assets managed or brokered as part of these offered services (often securities) usually belong to the individual clients directly or in trust, although the company provides management, depository or other services to the client. The company itself has no direct claim to the assets, so it does not record them on its balance sheet (they are off-balance-sheet assets), while it usually has some basic fiduciary duties with respect to the client. Financial institutions may report off-balance-sheet items in their accounting statements formally, and may also refer to "assets under management", a figure that may include on- and off-balance-sheet items.

Under previous accounting rules both in the United States (U.S. GAAP) and internationally (IFRS), operating leases were off-balance-sheet financing. Under current accounting rules (ASC 842, IFRS 16), operating leases are on the balance sheet. Financial obligations of unconsolidated subsidiaries (because they are not wholly owned by the parent) may also be off balance sheet. Such obligations were part of the accounting fraud at Enron.

The formal accounting distinction between on- and off-balance-sheet items can be quite detailed and will depend to some degree on management judgments, but in general terms, an item should appear on the company's balance sheet if it is an asset or liability that the company owns or is legally responsible for; uncertain assets or liabilities must also meet tests of being probable, measurable and meaningful. For example, a company that is being sued for damages would not include the potential legal liability on its balance sheet until a legal judgment against it is likely and the amount of the judgment can be estimated; if the amount at risk is small, it may not appear on the company's accounts until a judgment is rendered.